Flexible financing, right from your platform

Attract more users with our flexible embedded financing options

Offer factoring directly through your platform

Integrate seamless payment and invoicing capabilities into your workflow.

Key benefits of embedded financing

The benefits are many, so we've highlighted our favorites.

Increase customer retention

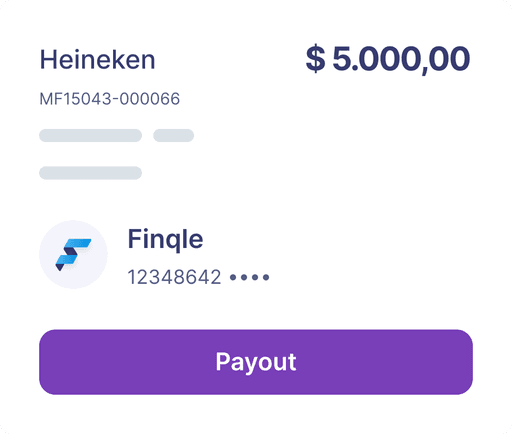

By offering embedded financing, your customers can access instant payments and manage their cash flow more efficiently, increasing their satisfaction and loyalty.

Submitted

Pending

Paid

Increase NPS score.

Monetize your user base by adding new services and features, giving your customers more reasons to engage with your platform.

Why embedded financing?

Strengthen your product offering and unlock new revenue streams while delivering added value to your customers.

Factoring

Status

Connected

Integrated

4 Modules

Onboarding KYC

Contract management

Hours + invoicing

Credit control

Benefits

Stay user-centric

Our technology enables your customers to access capital, improve cash flow, and grow their businesses, all within your ecosystem.

Automated Invoicing & Payments

Streamline invoicing and payments, handling everything from onboarding to processing.

Secure, Flexible Onboarding

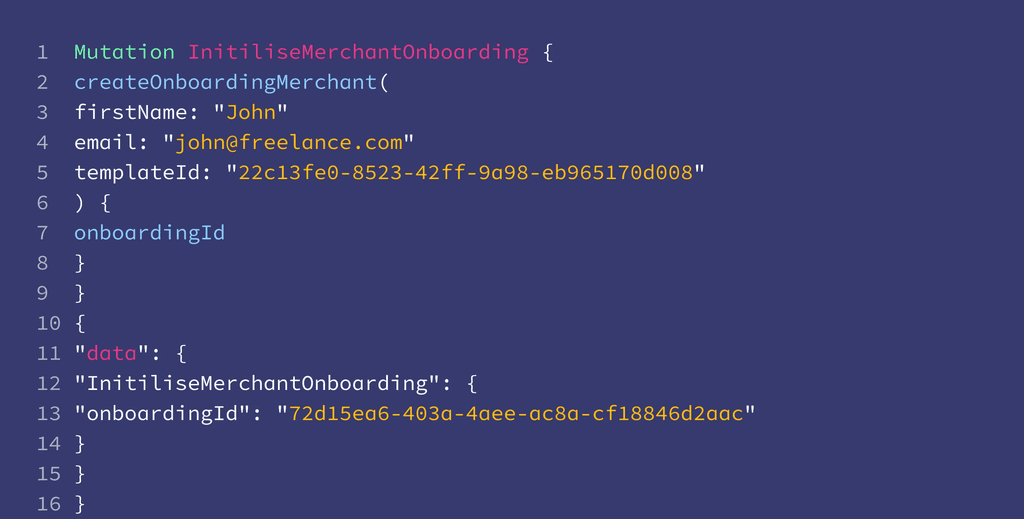

AI-powered, compliant onboarding with flexible contracting options.

Global Real-Time Payments

Instant payouts and payment consolidation across currencies for international platforms.

Use our additional modules, or use yours.

With our modular services, integrating is simple and scalable.

How it works

You're ready in 3 simple steps

Reach Out & Map Your Needs

Contact us to discuss your goals and challenges. We’ll identify the best solutions for your business.

Integrate seamlessly

With our API and developer support, embedding our financing solutions is quick and easy.

Succeed & Grow

Offer seamless financial services to your users, boost retention, and unlock new revenue streams.

clients